Acrs depreciation calculator

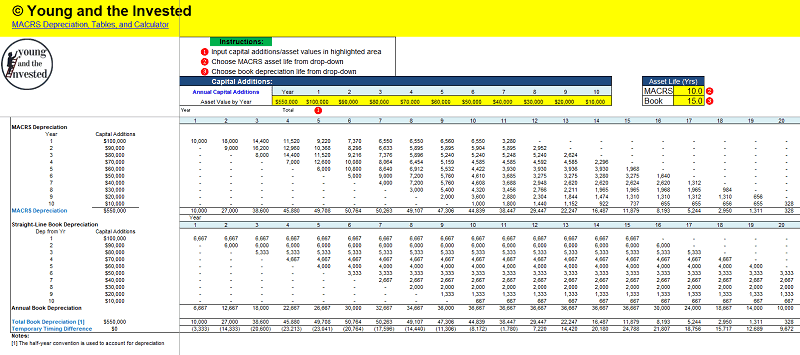

Depreciation Deduction under MACRS and the Original ACRS Systems. Our car depreciation calculator uses the following values source.

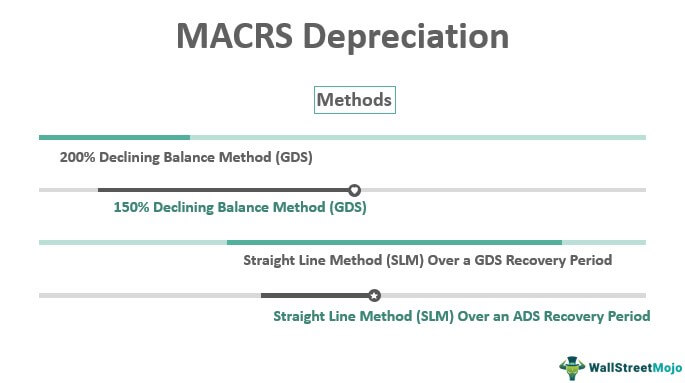

Macrs Depreciation Definition Calculation Top 4 Methods

After two years your cars value.

. 531 is a basic reference tool for determining the depreciation deduction under both the modified accelerated. The first-year depreciation calculation is. Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12 months and is a number M months the first and last years will be.

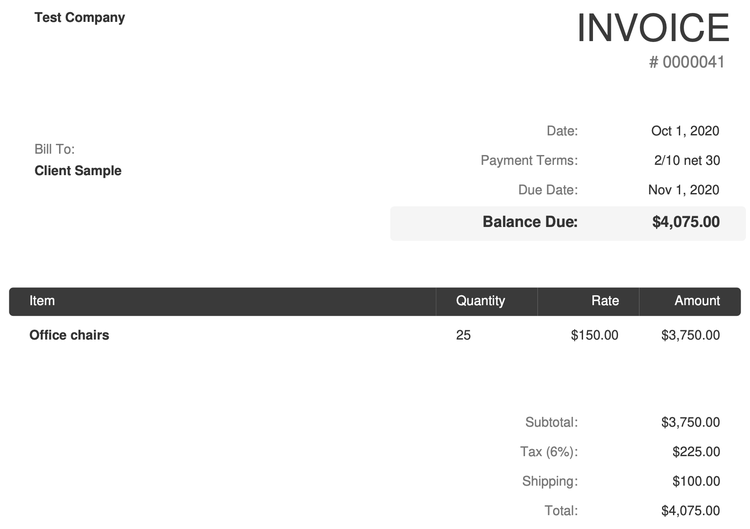

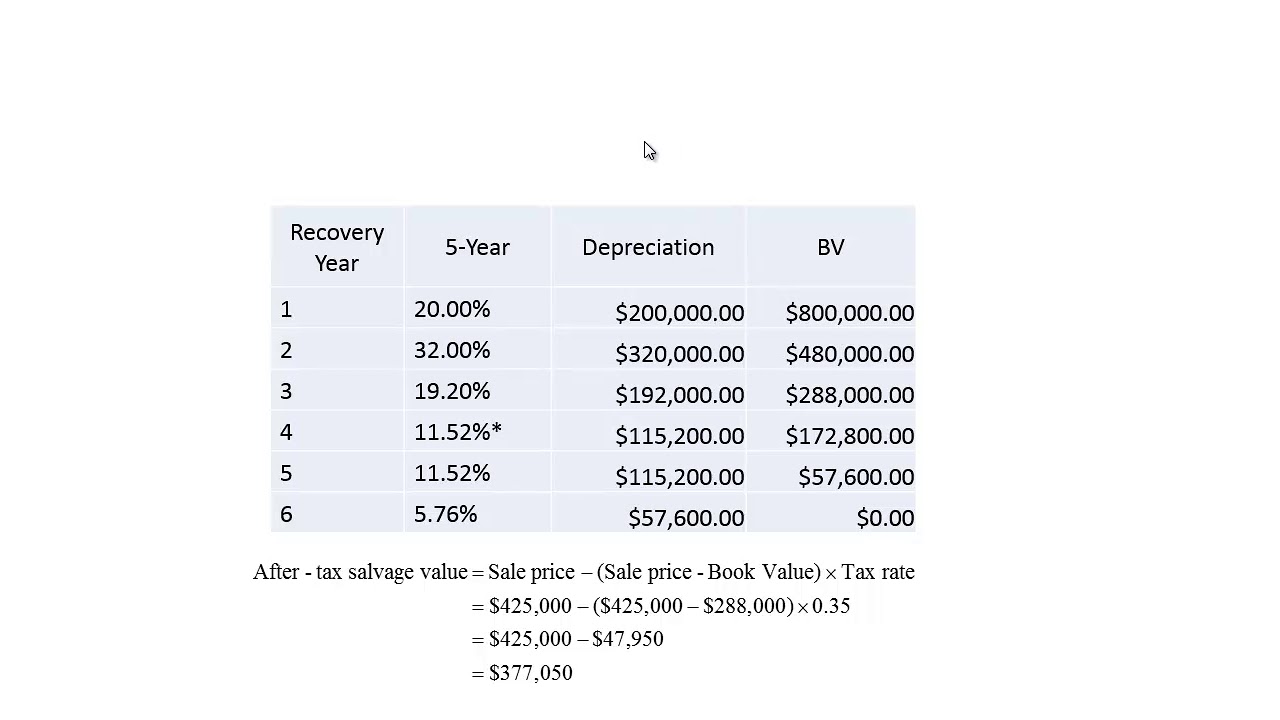

Then select your favored. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. The MACRS Depreciation Calculator uses the following basic formula.

ACRS depreciation allows assets to be depreciated over periods shorter. Secondly choose an appropriate recovery time for property from the dropdown list. Select the depreciation method whether its straight line or declining balance 200.

Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate the rate and expense amount for personal or real property for a given. Just input the original price of the property. Firstly input an asset basis and then the percentage of Business-use.

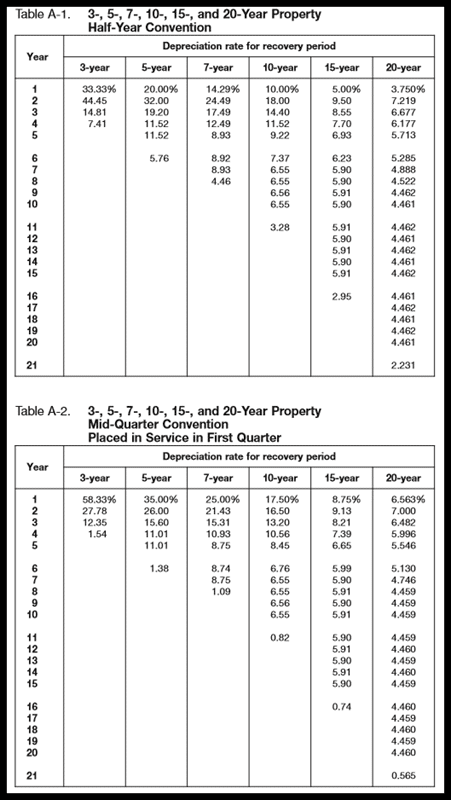

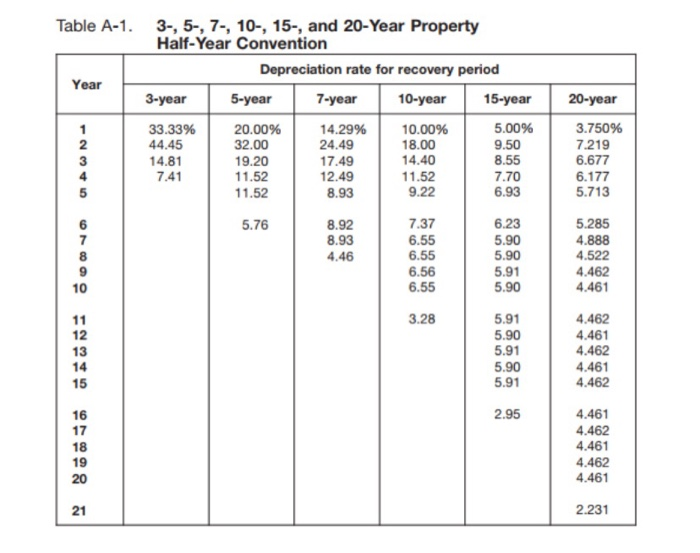

Bloomberg Tax Portfolio Depreciation. Using the MACRS 5-year column on the Depreciation Table heres the calculation which multiplies the basis dollar amount by the appropriate depreciation percentage. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round.

MACRS and ACRS No. Find a Dedicated Financial Advisor Now. For property you placed in service after 1986 you must use MACRS.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. This calculator uses the same formulas used in the Depreciation Schedule where depreciation is calculated without using the MACRS half-year mid-quarter or. By calculating the property the basic cost is depreciated so there remain no salvage.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. Follow the simple steps shown below to go on with the calculation. The calculator makes this calculation of course Asset Being Depreciated -.

You must continue to figure your depreciation under ACRS for property placed in service after 1980 and before 1987. Cost of the asset salvage value. Uses mid month convention and straight-line.

Di indicates the depreciation in year i C indicates the original purchase price or. We also include the MACRS depreciation tables from the IRS and an. ACRS formula calculations apply ACRS depreciation to an asset by using the straight line remaining life formula.

Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion. Depreciation is calculated each year for tax purposes. After a year your cars value decreases to 81 of the initial value.

Ad Do Your Investments Align with Your Goals. Our free MACRS depreciation calculator will provide your deduction for each year of the assets life. This depreciation calculator is specifically designed for a property that is real estate or rental property.

How do you calculate allowable depreciation. Di C Ri Where. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Pin On Business Formulas And Calculations

Depreciation Schedule Template For Straight Line And Declining Balance

Modified Accelerated Cost Recovery System Macrs A Guide

The Mathematics Of Macrs Depreciation

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

How To Calculate Macrs Depreciation When Why

Solved How To Calculate Depreciation If The Equipment Was Chegg Com

Lesson 7 Video 6 Modified Accelerated Cost Recovery Systems Macrs Depreciation Method Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Macrs Youtube

Macrs Depreciation Table Calculator The Complete Guide

Macrs Depreciation Calculator With Formula Nerd Counter

Verify Depreciation Information

Macrs Depreciation Calculator Straight Line Double Declining

What Is The Macrs Depreciation Method

Macrs Depreciation Calculator Straight Line Double Declining